On Friday 13-9-2013 Rabobank (the Dutch bank with the largest exposure in mortgages in the Netherlands) indicated that the Dutch housing market was 10% undervalued. This was partially supported by the CPB who is expecting a recovery in 2014.

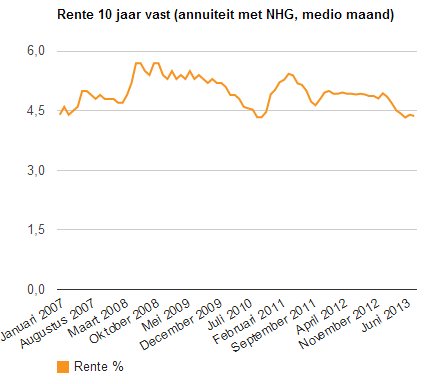

One may wonder how the Rabobank and the CPB “calculated” this forecast number as the same CPB expects that the average purchasing power will decline next year with 0,5% and expects that unemployment will increase from 8.7% to 9.25% (7.5% according to international definition?!). Including credit tightening with Dutch banks and lack of international appetite for Dutch mortgage funding, I guess expected interest rate will be the main driver for Rabobank its forecast model. I wonder if the Dutch government is desperately hoping for a wealth effect, as Zerohedge previously wrote about in relation to the US housing market, for the Netherlands.

Going one step further, on September 17th the Dutch prime minister will present the governmental budget plans for the year 2014. This includes a forecast on budget shortage of 3.3% of GDP for the year 2014. As mentioned earlier the CPB included an expected price increase of the Dutch housing market for the year 2014 in its forecast model. If this model also includes an expected decreased in mortgage interest rates and a subsequent wealth effect. I fear the real austerity is yet to start… We will see what 2014 will bring to us.