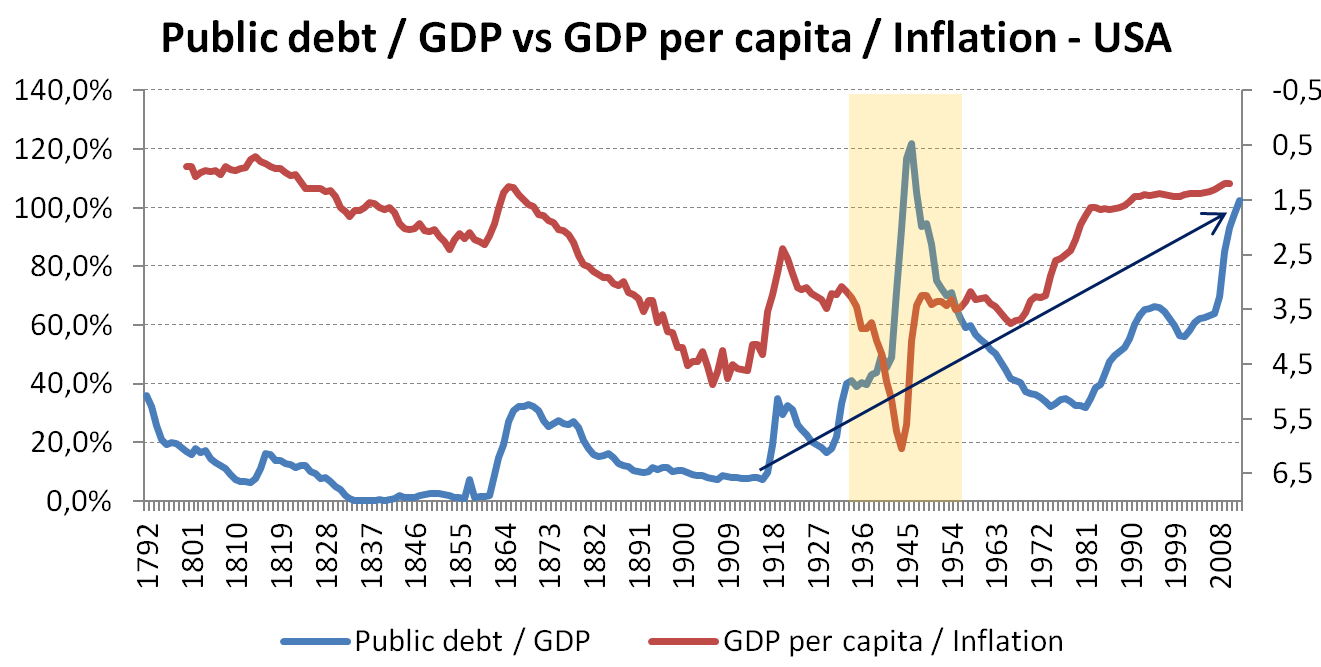

And as a bonus some dates which may have had a great impact on the above chart:

1913 http://nl.wikipedia.org/wiki/Federal_Reserve

1933 http://en.wikipedia.org/wiki/Glass/Steagall_Legislation

1945 http://en.wikipedia.org/wiki/Bretton_Woods_system

1971 http://en.wikipedia.org/wiki/Nixon_Shock

1999 http://en.wikipedia.org/wiki/Gramm-Leach-Bliley_Act

Category Archives: US

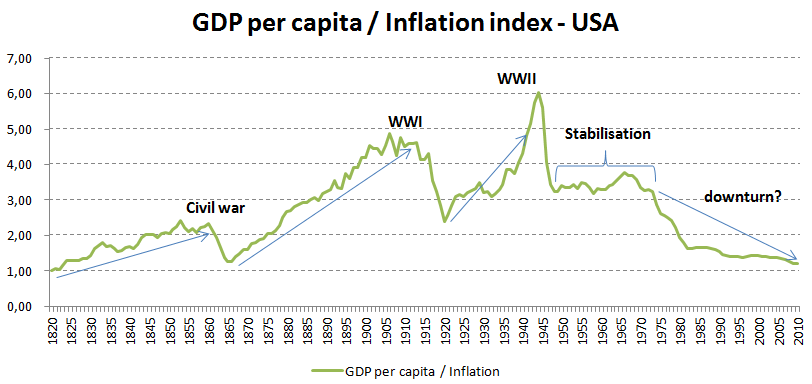

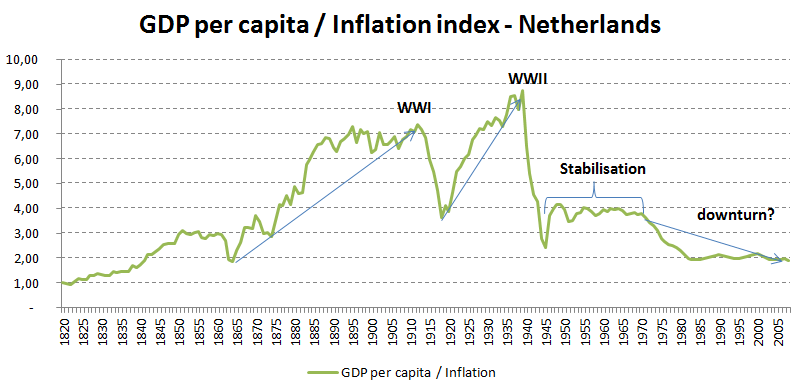

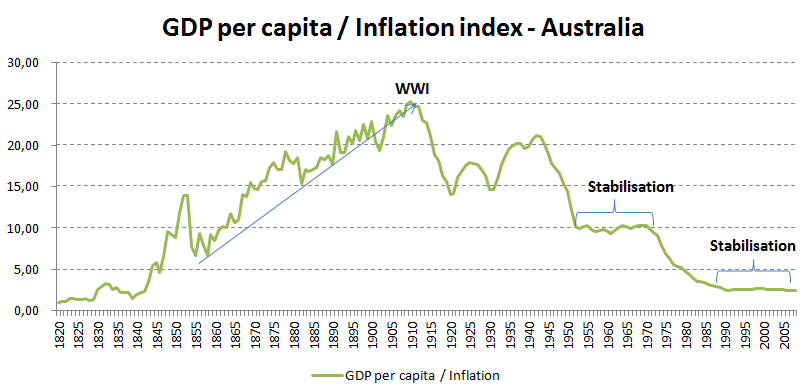

Has the world real wealth peaked long ago?

Has the world real wealth peaked in 1970 and has it been going down for many years?

Sources:

http://www.reinhartandrogoff.com/data/browse-by-topic/topics/2/

http://www.rug.nl/research/ggdc/data/maddison-historical-statistics

Is the current financial system at the end of its physical life cycle?

I do not know…

I have tried to compare the current financial system with a machine. A machine which after being used for a long time becomes obsolescent. I could however not find a reasoning that would satisfy an answer to the question raised in the title. Money has been used for a very long period of time and is still being used all over the world.

But money is an umbrella definition of a trade instrument (like a dollar and a euro which are created in a monopolistic environment). So I then tried to look at this question from a different point of view. I have tried to look for examples in history where there have been monopolies in sectors for a long period of time. In the end all these monopolies have seeded to exist. Sometimes due to human ingenuity, overproduction, other times by obsolescence and perhaps also after a period of time due to lack of existence/total depletion.

Can the current financial system be described as a monopolistic system? Is it different when the existence and continuity of a monopoly is enforced by law? In history there have been many examples of situations in which a monopoly has been misused to the advantage of the few. Is this the case with our current financial system as well? Is the current financial system misused by the few? Who has benefited from the monopoly? Who benefits from QE?

Perhaps the answers to the above will provide us the answer to the question raised in the title….

FED will likely expand QE instead of Taper in next half year

So, I’ve said it.

With Saudi Arabia in a diplomatic crisis with the US, Central banks all over the world entering into cross currency swap agreements with China, Europe’s stalling economies and a further increased demand in physical gold holdings we will see a decrease in foreign US treasuries demand in the coming months.

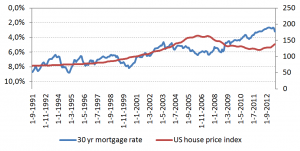

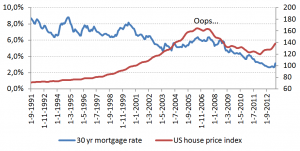

The FED will not allow that this decrease in demand, as an increase in interest rates of US treasuries will further lower expected GDP growth rates and ultimately destroy the fragile US economic recovery. This is because increasing mortgage lending rates will result in decreasing property prices and lower consumer spending. In the end will will see a Wealth Effect in reverse. To keep interest rates low the FED will likely increase QE and not taper in the coming half year.

It is not likely that the US government will cut spending’s and run a surplus within 2 years. Therefore the key question is, when will this increase in QE result in a spiral that we have seen so many times before in history?

PS. are the declining oil prices a silent diplomatic war between the US and Saudi Arabia? We all know that the governmental expenses of Saudi Arabia (keeping the population happy and pay for the 10.000+ princes) have increased so much that historic oil prices are likely to result in civil unrest.

Who owns the US debt?

http://useconomy.about.com/od/monetarypolicy/f/Who-Owns-US-National-Debt.htm

Corruption and Prosperity

For me, one of the most important items for predicting economic growth and future prosperity is a countries increase in ranking or position on the below mentioned table:

http://cpi.transparency.org/cpi2012/results/

The Netherlands ranked 7th in 2010/2011 and decreased to a 9th position in 2012. Lets hope this has been a temporary decline.

Please have a look for yourself how the GIIPS are ranked compared to Germany, Netherlands, Austria, Denmark etc. This is Europe 🙂

Water and bread – panem et circenses

The old Romans already knew that it was up most important to keep the poorest part of the population happy. The roman writer Juvenalis (60-140 AD) already wrote panem et circenses. In his writings he used this phrase sarcastic, to show that the citizens were ignorant about the already declining status and importance of the roman empire in the world. As long as there were games and bread for free, the nation was “happy”. It seemed to him that the citizens were unable/unwilling to see the real problems.

The same can be seen these days. As long as citizens have entertainment (TV/Internet) and social welfare (food stamps / social housing etc.) politicians do not have to fear the population. But as soon as one of these historically secured “rights” disappear, the politicians have a problem. Yesterday in this has already happened on a very small scale when the US food stamp systems crashed. The Washington Post already indicated that if the debt ceiling would not be raised that “the Obama administration will have to decide whether to delay — or possibly suspend — tens of billions of dollars in Social Security checks.” I’m actually afraid of what will happen when the population do not have their “panem et circenses” any more…

It seems that the current American citizens have more in common with the roman citizens then they would think themselves.

Is inflation actually a good thing?

Inflation….

During my time at the University in Amsterdam, I’ve learned that inflation is key for a healthy economy. Negative examples of lack of inflation (or deflation) has always been Japan, a theme relevant again since the financial crisis, which lead to limited inflation in European countries. News agencies have stated that one of the key qualities of Bernanke, which lead to his appointment of Chairman of the FED, has been his in-dept research on alternative tools the central bank of Japan could have used to fight deflation (i.e. increase inflation). Other literature also indicates that inflation increases consumer spending as a dollar earned today will be worth less in the future, increasing direct consumption and decreasing savings.

- But why is inflation good?

- Who actually benefits from inflation?

- Is 5000% inflation in 100 years a good thing?

- Does the consumer benefit from inflation?

I’ll try to briefly touch base on the above topic to inform you about inflation. I’ll let you decide if inflation is a good thing.

In my view inflation leads to a decreased saving appetite, increased spending on consumption goods and decreased spending on capital goods (which are in general more expensive). Inflation leads to increased credit demand (mortgages / car loans) as a consumer loses purchase power on saving money for expensive capital goods like cars and houses. Inflation may lead to a short term spending horizon, which in addition leads to increasing spending on consumption goods. Inflation together with advertisements are in my view one of the main drivers on our consumer society, which is unsustainable in the long run as resources are limited.

One might say that inflation is good for consumers as most people have high mortgages. With high inflation the mortgage stays the same, but the housing prices increase with inflation in the long run > decreasing the loan to “home value” (LTV) ratio over time. One might forget that the consumer compensates the bank for inflation in its annual interest paid (I’ll explain this later). This only works in a society in which consumers have high debt. A situation with zero inflation would considerably decrease mortgage expenses and decrease debt as financials headroom is used for loan repayment instead of inflation compensation.

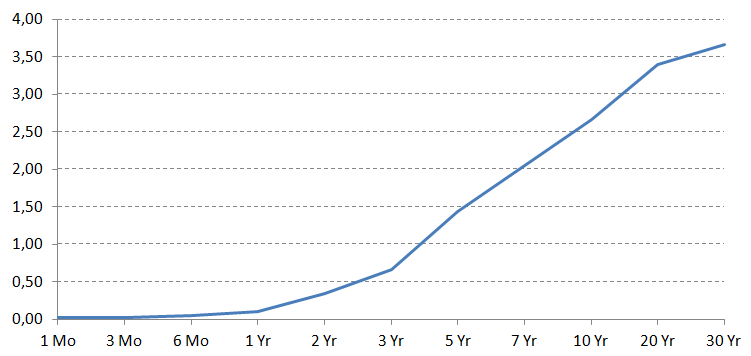

When we look at the past 100 years we see an average inflation per annum of 3.5%. Looking at today’s US treasury Yield Curve the 1 month yield is close to the 0% FED rate and the 30 year yield is close to the long term average inflation rate of 3,5%. One can state that the current US Treasury only compensates treasury holders for the long term average inflation, e.g. zero non repayment risk is actually priced in.

How does inflation influence interest rates?

In the recent period (and current situation) the long term interest rate has been higher compared to the short term interest rate. This is driven by among others higher expected inflation in the future. This is the reason why interest rates between 10 year and 30 year (close to long term inflation average) differs less compared to current 3 months & 10 year interest rate.

Is inflation the main driver for market’s need for interest swap derivatives?

One of the most used derivative is the interest rate swap, which swaps flexible interest rates for a fixed interest rate (3 months Euribor + x% = 5 year fixed rate) and vice verse. In my view without inflation, we can expect relative flat interest rates, which makes interest derivatives mostly obsolete.

Why is there inflation?

Inflation happens when money/credit supply exceeds adjusted demand for goods/loan redemption. Simply stated; if the world has (1) 100 inhabitants and (2) there are 100 dollar in circulation in the economy and there is (3) one apple tree which provides 100 apples each year and (4) all an inhabitant needs is 1 apple a year and (5) all inhabitants work at the tree company and earn 1 dollar a year. The price of an apple is 1 dollar. When a bank is incorporated and provides 50 dollar credit to the inhabitants (without any interest) the second year (one might want more then one apple), there are now 150 dollars available in the economy. With a stable supply of 100 apples, the price for an apple will slowly increase to 1,5 dollar.

Who benefits from inflation?

In an ideal world with 0 short term and long term inflation, a person borrowing money would pay for non repayment risk as well as opportunity cost to the person/bank he borrows money from. The risk on non-repayment decreases when the person buys a home from the loan as this will increase the collateral. When the market value of the collateral is close to the loan amount, non-repayment is limited when the Lender has a pledge on the collateral. (selling the home will result in repayment of the loan). A result of a pledge on the above collateral will result in a lower interest the person has to pay to the Lender (close to the opportunity cost).

Now one example:

Option 1 with zero inflation: Now lets say the above person has to pay 2% interest rate for a 30 year loan to the above Lender. In addition the person repays the total loan in 30 years (3,33% per year). After 30 years he has fully repaid the loan and he owns the house.

Option 2 with inflation: Now lets say there is a 3,5% long term inflation. The lender wishes to be compensated for the 3,5% inflation in addition to the 2,0% interest rate. The Lender now has to pay 5,5% interest rate per annum and had no money left for loan repayment. After 30 years of interest payment. The person still had both a home and full loan amount. In purchase power however the loan decreased with 3,5% over 30 years = 65% or in other words. If the house would have cost the Lender 100 dollar, the house would now be worth 100 x 3,5% price increase per annum = 280 dollar.

In a next topic I’ll continue on the question who actually benefits from inflation.

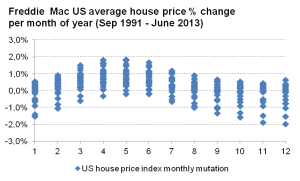

Looking into the data provided by Freddy Mac I would not have thought the data would have been so nicely distributed. One can only benefit from this overview as it seems that nearly everybody is happy during spring time.

And some additional charts: